How Does Overfunded Life Insurance Work

Riders are a way of adding extra coverage or. For Indexed Universal Life Insurance to work in your favor you have to assume many factors going precisely according to plan all of the time.

Why I Love Overfunded Whole Life Insurance 2019 Youtube

Cash value builds up in your permanent life insurance policy when your premiums are split up into three pools.

How does overfunded life insurance work. To overfund an indexed universal life insurance policy means to maximize the policys cash value growth potential and minimize its net insurance costs over timeWhen the maximum premium is paid into the policy cash values grow faster which leverages the net amount of life insurance at riskThe net amount of life insurance at risk is the difference between the actual face amount of the. When youre considering life insurance or an annuity many of the products youll find will guarantee a certain level of growth. For instance the accumulated cash value which you can use during your life and death benefit within a whole life insurance policy are guaranteed to grow and may grow even faster if your policy earns dividends.

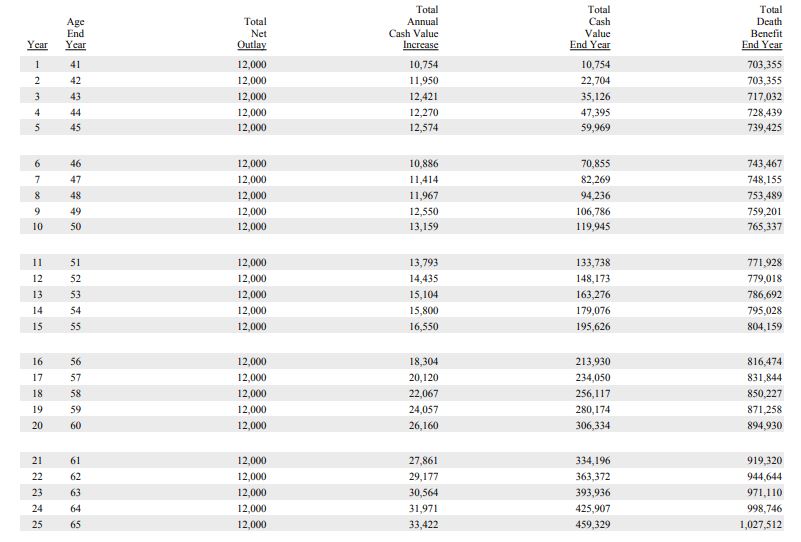

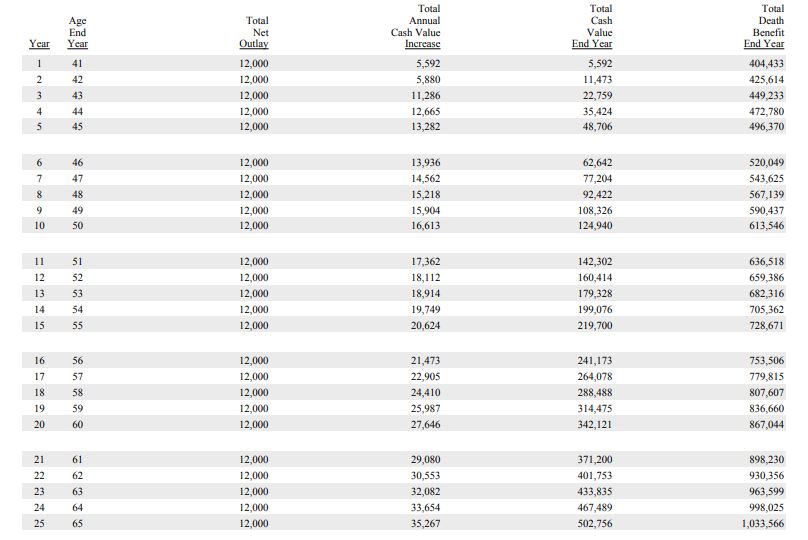

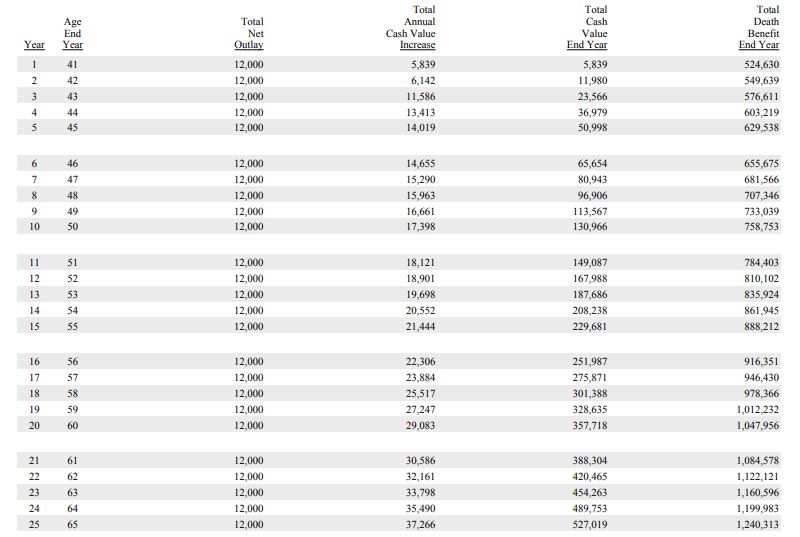

So by overfunding your policy you contribute more to the cash value. Overfunding a life insurance policy both universal life and whole life insurance allows you to take more significant advantage of the guaranteed and non-guaranteed build up of cash value. If you have a client who is interested in overfunding life insurance it is important that the policy is carefully structured to ensure funding sufficiently exceeds policy costs and to enable.

Whole life insurance offers a guaranteed interest rate from the insurer plus potential dividends that are based on numerous factors such as the insurers business performance. Also this cash value grows predictably and safely. You have to pay premiums as illustrated and on time.

But essentially when you see an advertisement for a 7702 Plan or. An overfunded policy will generate cash value faster and can possibly increase the death benefit or dividends. In our opinion a better way to market life insurance under 7702 would be to simply call it a life insurance retirement plan or LIRP.

To receive dividends the policy must be issued by a mutual life insurance company. What Is Overfunded Life Insurance. One portion for the death benefit one portion for the insurers costs and profits.

Think of it like this. The index and therefore the underlying market would have to have positive real rate of return not just a positive average. Emergencies education expenses retirement funds etc.

The extra money they pay goes into the policys cash value and grows tax-deferred. Overfunded life insurance is when you pay more into a policy than is required. However with indexed universal life insurance consumers may choose to pay higher premiums because it provides the death benefit protection they desire but also the ability to accumulate cash value that can be accessed for various reasons such as.

Permanent life insurance with cash value can provide you with a pot of tax-free money in the form of a policy loan. Like other life insurance policies including whole life insurance and term life insurance you can add a variety of riders to universal life policies. When you die your beneficiary will receive a set amount of money which was determined when you bought the policy and the premium was calculated.

Permanent life insurance policies such as whole life insurance or universal life insurance have a cash value component. Overfunded Cash Value Life Insurance maximizes cash value and minimizes death benefits. When you own a cash value life insurance.

To build up enough cash value to supplement retirement some policyholders choose to overfund their cash value life insurance policies by paying well over the required premium each month. Life insurance is a very common asset that figures into many peoples long-term financial planningPurchasing a life insurance policy is a way to protect your loved ones providing them with the. If you have an outstanding loan and you surrender or lapse your.

The idea is that they build cash value quickly that you can access for any reason. Returns for whole life insurance policies usually are in the 45 percent to 6. Unlike term life insurance which covers only a set number of years whole life insurance is meant to be for life.

An overfunded life insurance policy is a Whole or Universal Life insurance policy or variation of those such as Indexed Universal Life in which more premium is paid in than required to secure the death benefit. In fact you may have heard people criticizing these plans for not really being a plan at all but rather overfunded life insurance.

Properly Structured Whole Life Insurance Your Guide Client Focused Advisors

Pua Why You Should Overfund Your Whole Life Insurance Stuarte

Life Insurance Loans A Risky Way To Bank On Yourself

The Pros And Cons Of Overfunding Life Insurance

What Is Overfunded Life Insurance

What To Look For In A Properly Designed Life Insurance Policy Illustration For Real Estate Investing Innovative Retirement Strategies Inc

Do You Really Want That Overfunded Cash Value Life Insurance Policy

Do You Really Want That Overfunded Cash Value Life Insurance Policy

Life Insurance Loans A Risky Way To Bank On Yourself

The Cons Of Overfunded Life Insurance Youtube

Do You Really Want That Overfunded Cash Value Life Insurance Policy

Do You Really Want That Overfunded Cash Value Life Insurance Policy

Overfunded Life Insurance The Insurance Pro Blog

Overfunded Life Insurance 15 Pros And Cons

What Is Overfunded Life Insurance

What To Look For In A Properly Designed Life Insurance Policy Illustration For Real Estate Investing Innovative Retirement Strategies Inc

Do You Really Want That Overfunded Cash Value Life Insurance Policy

Is The Infinite Banking Strategy Using Whole Life Insurance Right For You My Personal Finance Journey

12 Questions To Ask About Whole Life Insurance Policies White Coat Investor

Post a Comment for "How Does Overfunded Life Insurance Work"