Medical Insurance While On Long Term Disability

Handling medical dental and vision deductions while an employee is on STD or LTD is completely dependent on the company-wide policy. Long-term disability insurance is one of the many benefits you may be entitled to from your employer.

The Difference Between Short Long Term Disability Insurance

If the employee is collecting a benefit from their disability policy they do not have to pay their disability premiums but their medical dental and vision premiums are still subject to be collected.

Medical insurance while on long term disability. Plus employers face the added stress of a dual responsibility to both the. Long term disability applicants often lose their employer provided health insurance coverage as a result of their disability. Although there are instances when your insurance company can legally terminate your benefits.

All long term disability insurance plans are backed by an insurance company in some way or another. Continued payments of benefits while the employee is on long term disability are at the discretion of the employer. In order to determine whether you will have continued health insurance coverage while you are on a short or long term disability leave you will need to examine the employers policies andor its benefits handbook.

Medicaid provides free or low-cost medical benefits to people with disabilities. Short-term disability coverage that you can buy on your own is less common but it does exist Long-term disability insurance definition. But if its paid by your employer then your disability payments may cease.

This type of insurance can provide you with a steady income in the event injuries illnesses or chronic health conditions prevent you from working. For example one common way is to sign up for group coverage. If you have a disability you have three options for health coverage through the government.

There are 9 questions you should ask yourself about your group health coverage and needs to help you make the right decision about COBRA benefits. Short and long term disability benefits do not cover the cost of health insurance premiums. Long-term disability insurance can offer years of.

Learn about eligibility and how to apply. Typically long-term disability LTD benefits can be paid through age 65 or 67. First as valkyryn suggests its not clear what you mean by disability -- if you mean company-provided short or long term disability companies are not legally required to continue to provide health care coverage to employees on such leaves but many do.

Your uncle should ask for a copy of the disability and health care. The following are six important things. These policies wont pay for medical expenses so be sure to have adequate health insurance.

The answer will depend on his employers disability plan language. However this does not mean that you will keep your employment throughout your disability. How much do you know about what happens when an employee goes on long term disability LTD benefit claim.

Long Term Disability coverage provides wage replacement that is between 50-70 percent of your earnings before a non-work related injury impacted your ability to work. Rather STD and LTD policies pay a percentage of your income while you are unable to work. However there are various ways you can go about doing so.

Medicare provides medical health insurance to people under 65 with certain disabilities and any age with end-stage renal disease permanent kidney failure requiring dialysis or a kidney transplant. Unfortunately just because a policy is in place it does not mean obtaining these benefits will be easy. If your disability benefits are paid by an insurance company then your employment status wont affect your benefits.

Disability coverage provides you with the support you need if you were to become hurt or sick and could not work. What you can do is to check with your employer about their policies to determine whether they do provide benefits or whether the employee still retains his employed status when he becomes disabled for an extended period of time. Long term care was designed to pay you in case of an illness or injury so severe you are no longer.

It depends on your disability insurance policy. Health insurance was designed to pay the medical bills of doctors hospitals testing facilities etc. Its called long-term because it has a benefit period thats at least five years long and which can go as long as to.

Long Term Disability and Its Benefits Long Term Disability LTD can be used following Short Term Disability STD plans or alone. Indeed we inform our clients receiving LTD benefits that their employment is likely to be terminated at some point. Long term disability can be used for health insurance but the two are completely different policies.

Long-term disability insurance LTDI replaces your income for a number of years when you become disabled and lose your ability to earn an income. Many employers arent sure about the details such as whether the health and dental benefits continue indefinitely or if the disabled employee is supposed to contribute toward the cost of their benefits. Long-term disability policies can replace up to 60-65 of your after-tax income until age 70.

This is most commonly done through an employer. If you have a special health care need like if youre terminally ill need help with daily activities get regular care at home or in another community setting live in a long-term care facility or group home or have a condition that limits your ability to work or if you have a disability you have a number of options for health coverage. The most common.

An employer is not required to maintain an employees health insurance coverage. You may also find group coverage through.

Getting Approved For Disability Benefits Here S What To Know Social Security Disability Benefits Disability Benefit Social Security Disability

Familienbonus Plus Das Wird Sich Ab 2019 Fur Familien Andern Gluckliche Kinder Familie Ist Selbstvertrauen Aufbauen

How Does A Long Term Disability Attorney Help In My Claim Disability Help Disability Social Security Disability Benefits

Do You Really Need A Long Term Care Plan Long Term Care Insurance Life Insurance Marketing Ideas Life Insurance Marketing

Click On The Image To View The High Definition Version Create Infograp Social Security Disability Benefits Disability Help Social Security Benefits Retirement

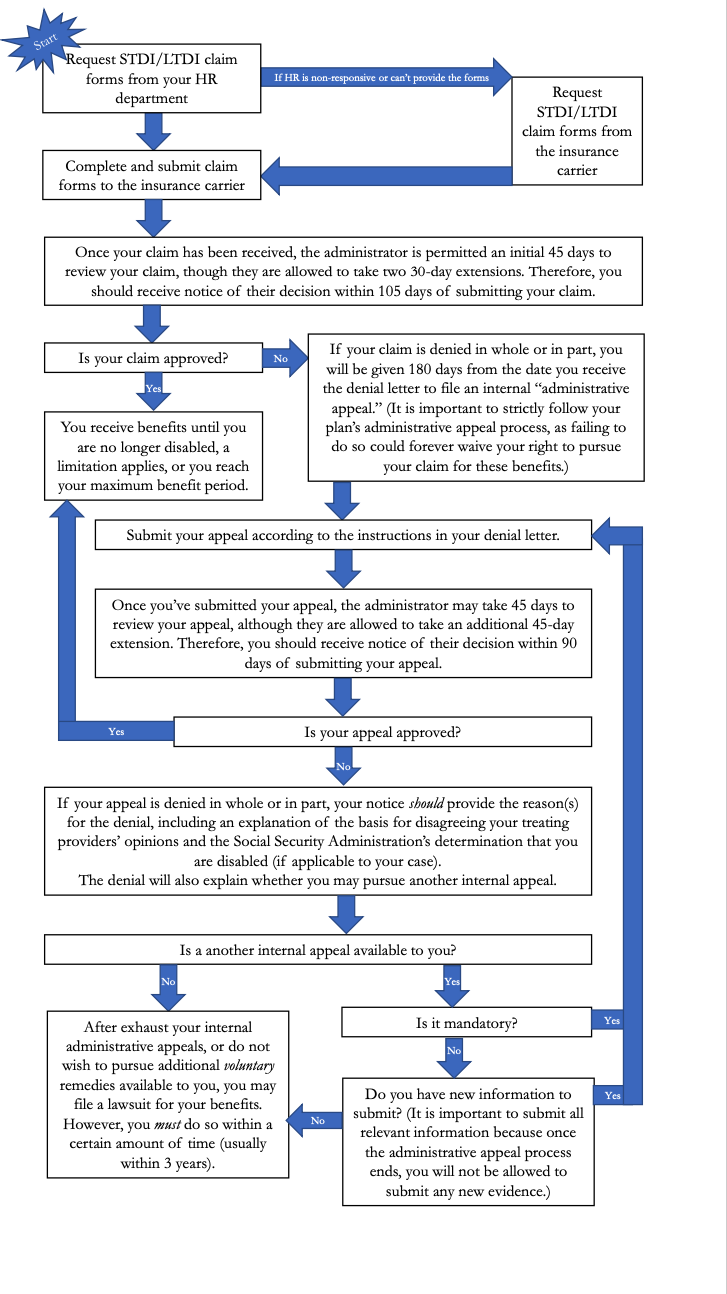

7 Effective Steps When Applying For Long Term Disability

Buy The Right Disability Insurance For Proper Coverage Life Insurance Policy Disability Insurance Family Life Insurance

Why Well Informed Educators Protect Their Paychecks With Disability Insurance Scholastic

Electronic Medical Records Quotes Zyvr Com Life Insurance Beneficiary Universal Life Insurance Emergency Medical Responder

Short Term Disability Insurance Short Term Disability Insurance Disability Insurance Life Insurance Policy

Youtube Doctor Medical Medical Disability

Do I Really Need Life Insurance Simple Money Mom Insurancequotes We Don T All Need Life Insurance However Most O Lebensversicherung Versicherung Leben

How To Claim Disability Benefits For Mental Health Conditions Hawks Quindel Website

Understanding Health Insurance Understanding Healthcare Health Insurance Tips Healthcare Healthinsu Health Insurance Buy Health Insurance Medical Insurance

Disability Insurance Is Coverage That Provides You With Income Protection Should You Lose Time On The J Disability Insurance Income Protection Source Of Income

Get The Best Short Term Health Insurance In Texas Health Insurance Best Health Insurance Disability Insurance

4 Things To Look For When Selecting An Insurance Provider In Singapore In 2021 Health Insurance Plans Healthcare Costs Private Health Insurance

How To Appeal A Long Term Disability Denial Denial Disability Appealing

Post a Comment for "Medical Insurance While On Long Term Disability"