Payment Protection Insurance Scandal Ireland

T he Central Bank has ordered the banks to find out how many payment protection insurance policies were wrongly sold. Original Artice From 2014 Updated in 2017 and 2019 to take account of legislation changes.

Ulster Bank Login Ulster Bank Banking Services

It pays out money to help cover mortgage repayments for a period if the policy holder cannot work due to an accident illness involuntary unemployment or accident.

Payment protection insurance scandal ireland. With our new Payment Protection Insurance we can arrange to have you covered. Terms and conditions apply. The group policy is underwritten by Sterling Insurance Group Limited a company authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the.

Typically you can protect up to 70 of your annual income and a PPI policy will provide payouts for up to 12 months if your claim is successful. Payment protection insurance PPI is a form of income protection that covers monthly debt repayments if youre unable to work. Payment protection insurance.

UK Banks Payment Protection Insurance Scandal Is Getting Costlier. Payment Protection Insurance PPI is an optional insurance cover which protects your loan repayments in the event of you becoming unable to. Unemployment sickness or an accident could seriously affect a borrowing members income.

Mortgage Payment Protection is an insurance policy that will cover your mortgage repayments if you as a PAYE employee are unable to work and remain so for 30 days or more due to an accident sickness or. PPI was designed to cover loan repayments if the policyholder became ill had. PPI is an optional insurance product that provides protection for mortgage repayments.

Anyone who loses their job or becomes unfit for work faces a sharp fall in income. The group Payment Protection Insurance policy is arranged by CUNA Mutual Group Services Ireland Limited a company regulated by the Central Bank of Ireland. This may be as a result of illness accident death or unemployment and will be covered on your policy.

Or illness and hospitalisation if state or self-employed. 11 billion more for claims related to payment protection insurance or. It also includes the use of stolen card data to buy items over the phone or via the internet.

Do not leave it lying around. Ireland Limited a company regulated by the Central Bank of Ireland. Lloyds Banking Groups decision to set aside 32bn to compensate customers who were mis-sold payment protection insurance has exposed the full extent of a scandal.

Crime Prevention Advice Keep your card in a safe place at all times. This type of fraud involves the use of stolen or counterfeit payment cards to make direct purchases or cash withdrawals. It protects your ability to repay your loan without taking money from your savings.

Our Mortgage Payment Protection insurance covers your monthly mortgage repayment in the event that you are unable to work due to an Accident or Sickness. Taking Insurance out on your Credit Union loan is easy and affordable. Such is the scale of the scandal.

Mortgage payment protection insurance explained. Payment protection insurance PPI is insurance that will pay out a sum of money to help you cover your monthly repayments on mortgages loans creditstore cards or catalogue payments if you are unable to work. The rent on their apartment lease payments on their car as well as subscriptions for public.

The cost of the payment protection insurance scandal has topped 40bn after Barclays took another 600m hit to pay compensation to customers who. At the same time their regular monthly outgoings remain the same. Payment Protection Insurance PPI provides borrowers with affordable inclusive supportive repayment insurance in the event of an accident sickness or involuntary unemployment.

Payment protection insurance guarantees your accustomed standard of living in tough times too. The issue of mis-sold payment protection insurance PPI was very widespread in the UK and it looks like the banks also tried to make easy profits from it here in Ireland. The battle over Payment Protection Insurance PPI has changed the face of the financial services industry in the UK.

This could be due to sickness an accident or involuntary unemployment. Payment Protection Insurance Protected lending at your Credit Union Repayment Protection Insurance PPI is an optional insurance cover which protects your loan repayments in the event of you becoming unable to work for more that thirty 30 certified days. The UK Financial Conduct Authority set a deadline for PPI refund claims which is August 29th 2019.

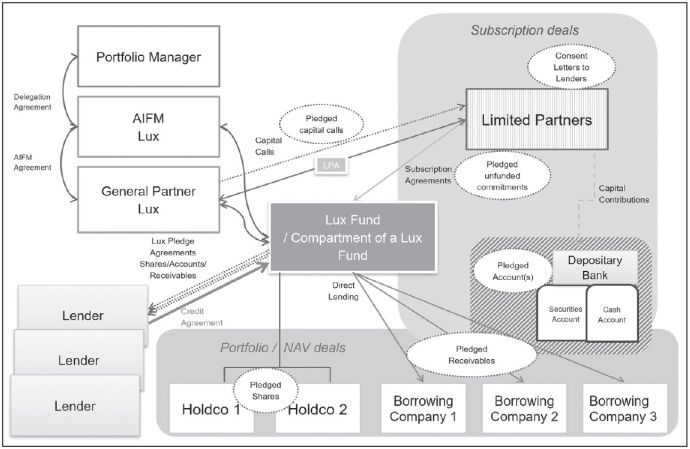

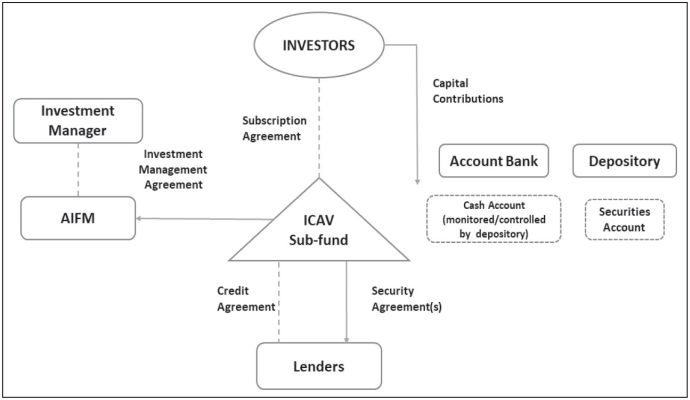

Fund Finance In Ireland And Luxembourg A Comparative Analysis Finance And Banking European Union

More From Yabadabadoo Saturdays Cool Brontosaurus Skeleton As A First Tattoo For My Friend Caseycasey Leigh Blackt Dinosaur Tattoos Tattoos Skeleton Tattoos

Pin By Irina Ursea On Abstract Skeleton Art Abstract Stegosaurus

Hsbc Wikipedia Hsbc Wikipedia Financial Services

Dimorphodon Prehistoric Creatures Megafauna Prehistoric

People May Have Noticed That A Lot Of Websites Have Different Cookie Banners Now Well This Is Due Content Marketing Finance General Data Protection Regulation

Most Common Witchcraft Paths By Jennifer March Witchcraft Witchy Witch

Bank Customers Will Pay The Price For Shrinking Competition

Fund Finance In Ireland And Luxembourg A Comparative Analysis Finance And Banking European Union

Pterodactyl Skeleton Vintage Illustration Pterodactyl Engraving Illustration

Ulster Bank Help Ulsterbank Help Twitter

Pin On Accidents De Voiture De Course Et Luxe

Vw And The Never Ending Cycle Of Corporate Scandals Payment Protection Insurance Scandal Cycle

Bank Customers Will Pay The Price For Shrinking Competition

Post a Comment for "Payment Protection Insurance Scandal Ireland"